Key Takeaways

- SEC launches ‘Project Crypto’: The agency has introduced a comprehensive initiative to establish clearer rules for crypto assets and exchanges.

- Most tokens not considered securities: The SEC states that the majority of crypto tokens, as currently used, do not meet its definition of a security.

- Aim to reduce confusion for newcomers: Officials indicated that the new framework is designed to help everyday people understand the risks and their rights in crypto investing.

- Guidance for projects and exchanges clarified: Crypto platforms are encouraged to review the updated guidelines to ensure legal compliance and user protection.

- Next steps include public comment period: The SEC will accept feedback from the public and industry for the next 60 days before finalizing new regulations.

Introduction

The U.S. Securities and Exchange Commission (SEC) today launched “Project Crypto,” introducing new guidelines that clarify how crypto tokens and exchanges are regulated nationwide. In a significant update, the SEC stated that most tokens do not qualify as securities. This move aims to reduce confusion for those new to crypto and to provide clearer rules for developers and platforms, as public feedback opens in the coming weeks.

New Framework Overview

The Securities and Exchange Commission has announced comprehensive guidelines for cryptocurrency regulation under its new “Project Crypto” initiative. The framework introduces a three-tier classification system for digital assets, ranging from fully regulated securities to minimally supervised utility tokens.

Under these guidelines, cryptocurrency projects must now assess their tokens against specific criteria to determine regulatory obligations. The SEC noted that factors such as token utility, decentralization levels, and marketing approaches will influence classification decisions.

To support industry participants, the SEC has established a dedicated review process for crypto ventures seeking clarification on their classification status. Project teams are invited to submit detailed documentation outlining their tokens’ technical and operational characteristics for assessment.

Stay Sharp. Stay Ahead.

Join our Telegram Group for exclusive content, real insights,

engage with us and other members and get access to

insider updates, early news and top insights.

Join the Group

Join the Group

Classification Categories

Digital assets will now be categorized as securities tokens, hybrid instruments, or utility tokens. Securities tokens, which offer investment returns or profit sharing, will face the strictest oversight under existing securities laws.

Hybrid instruments combine both investment and functional features. These tokens require adjusted compliance measures that the SEC has tailored for the unique aspects of blockchain-based assets.

Utility tokens that serve purely functional purposes within decentralized networks will be subject to lighter regulatory requirements. The SEC explained that these tokens must demonstrate clear technical utility and should not be marketed with an emphasis on investment potential.

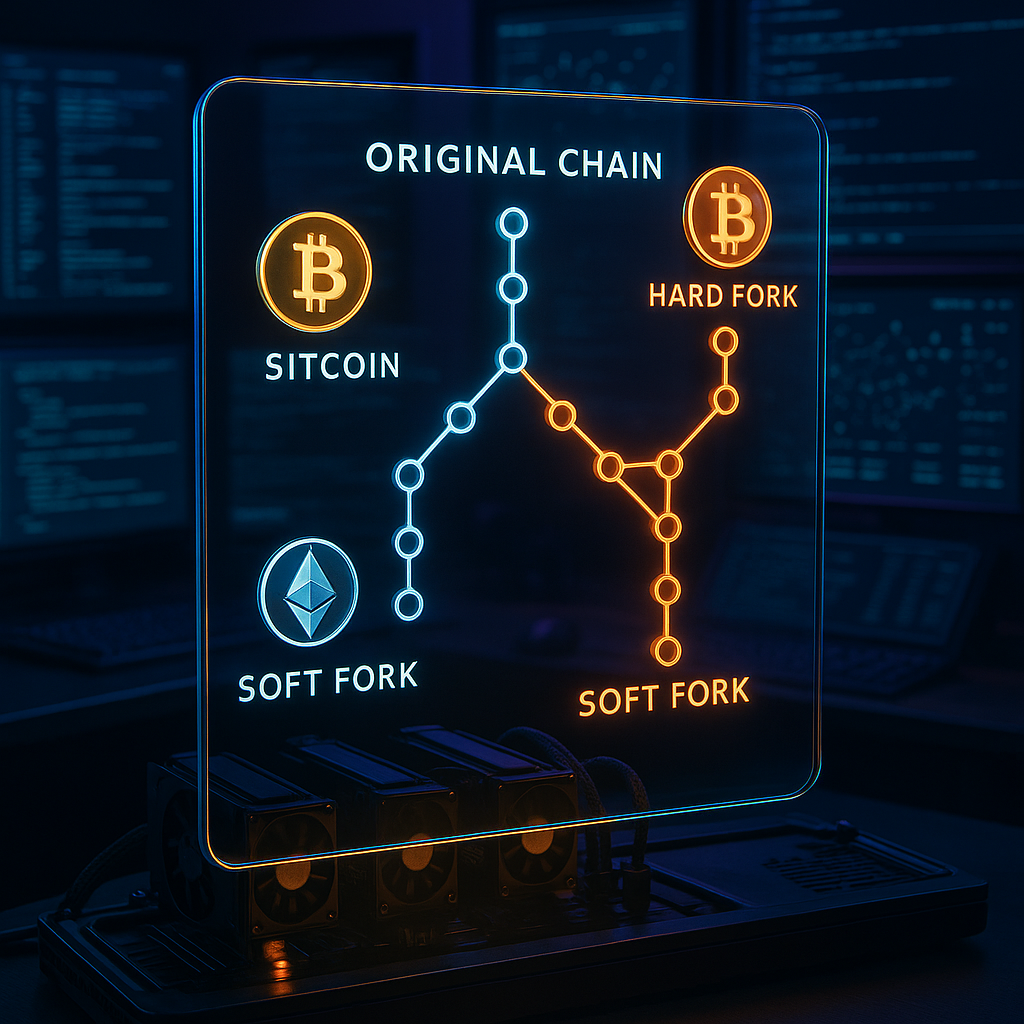

For investors interested in understanding the technical backbones of various cryptocurrencies, learning about concepts such as blockchain consensus mechanisms can be valuable as these often determine how network utility and security are defined.

Compliance Requirements

Project teams are required to submit documentation detailing their token’s technical architecture, governance structure, and intended use cases. The SEC has created standardized forms and templates to simplify this reporting.

Ongoing reporting obligations depend on classification. Securities tokens must provide quarterly updates and annual audits. Hybrid instruments face modified reporting schedules. Utility tokens need to maintain technical documentation and user guidelines.

Additional investor protection measures must be implemented, such as clear risk disclosures and strong security protocols. The SEC stated these requirements aim to protect users while encouraging responsible innovation.

Developers who wish to strengthen project safety may find resources such as crypto scam prevention checklists especially relevant under the new compliance obligations.

Industry Response

Major cryptocurrency exchanges have welcomed the clarity provided by Project Crypto. Coinbase CEO Brian Armstrong said the framework “creates a clearer path forward for compliant token listings and trading operations.”

Some blockchain developers, however, have raised concerns about compliance costs. The Blockchain Association noted challenges for smaller projects, stating that extensive documentation requirements could strain limited resources.

Legal experts consider the framework a substantial move toward regulatory certainty. Sarah Johnson, a partner at Morrison & Cohen specializing in digital asset regulation, explained that the new guidance fulfills industry requests for concrete direction.

For further education on security in practice, the community can look at case studies of DeFi hacks and security lessons to inform their strategies.

Implementation Timeline

The SEC has outlined a phased rollout beginning next quarter, with existing projects given six months to complete initial classifications. New projects must incorporate the guidelines into their launch plans immediately.

Enforcement actions against non-compliant projects will begin after the grace period ends. The SEC expressed willingness to collaborate with projects making good-faith efforts to comply during the transition.

Training sessions and workshops will be available throughout the implementation period. Additional educational materials and compliance templates are scheduled for release in the coming weeks.

Support Resources

The SEC has established a dedicated help desk for projects seeking guidance on classification. Technical specialists will be available to address questions about documentation and compliance processes.

Stay Sharp. Stay Ahead.

Join our Telegram Group for exclusive content, real insights,

engage with us and other members and get access to

insider updates, early news and top insights.

Join the Group

Join the Group

A new online portal will streamline submission procedures and provide real-time updates on application status. Projects will have access to templates, guidelines, and educational materials through this centralized platform.

Regular industry roundtables are planned to encourage ongoing dialogue between regulators and project teams. The SEC stressed its commitment to refining the framework based on feedback from practical implementation and evolving market conditions.

For teams designing new utility tokens, it’s critical to consult guides on tokenomics and crypto supply to ensure alignment with regulatory expectations regarding network utility and distribution.

Conclusion

The SEC’s Project Crypto marks a major change in how digital assets are classified and regulated, bringing clearer rules for both emerging and established crypto ventures. This approach aims to balance investor protection with practical industry needs, offering a structured process for determining compliance responsibilities.

What to watch: phased implementation begins next quarter, with a six-month classification window before enforcement actions start and additional guidance materials expected soon.

If you are new to crypto investing or platform development, you can further your understanding by reviewing step-by-step resources such as beginner cryptocurrency guides, which explain foundational concepts and security essentials for navigating the changing regulatory landscape.

Leave a Reply