Key Takeaways

- Move from hidden holdings to documented clarity. Maintain a clear, jargon-free record of all your wallets, holdings, and detailed access instructions so recovery remains practical and transparent for your beneficiaries.

- Bulletproof your seed phrase and private key storage. Safeguard seed phrases and private keys with strong, offline strategies such as encrypted hardware solutions blended with practical access mechanisms for trusted heirs.

- Empower heirs with actionable guidance, not just passwords. Go beyond sharing credentials by providing step-by-step, plain-language instructions. This ensures even non-technical beneficiaries can confidently access, transfer, or manage your crypto assets.

- Ensure legal compliance with up-to-date documents. Draft and regularly update wills and beneficiary documents that specifically address digital assets in clear, lawful terms, helping prevent probate delays and disputes.

- Adopt multi-signature wallets for extra security or shared access. Implement multi-signature wallet setups that require multiple approvals for transactions. This approach supports safer and more collaborative inheritance planning.

- Find the balance between fortress-level security and accessibility. Avoid creating overly secure systems that become impenetrable to heirs. Choose strategies that deliver robust protection alongside realistic, usable recovery paths.

- Regularly review and update your succession plan. Keep all documentation and procedures current to reflect changes in wallets, assets, regulations, and family circumstances, ensuring a smooth transition for your heirs.

- Close the knowledge gap with proactive education. The greatest risk isn’t just the loss of keys, but the loss of know-how. Invest time in teaching your beneficiaries about accounts, devices, and safe crypto practices to empower them for future stewardship.

By prioritizing both secure storage and practical accessibility, your crypto estate plan transforms into a true legacy tool. You empower your loved ones, ensuring they’re never left in the dark. Let’s walk step by step through each actionable measure to build confidence and clarity into your digital asset succession plan.

Introduction

Losing access to a password is frustrating, but a lost crypto wallet can erase an entire digital asset legacy, leaving loved ones with nothing regardless of your careful planning. For crypto investors, estate planning isn’t a simple legal checkbox. Instead, it’s the essential bridge connecting your digital achievements to the people you care about most.

This step-by-step checklist transforms crypto inheritance from daunting to practical. Here, you will discover how to document holdings in plain language, secure seed phrases without locking out future heirs, and provide practical guidance that anyone (regardless of technical ability) can follow. Together, we’ll craft a succession plan that safeguards both your assets and your family’s financial future.

Understanding Crypto Asset Inheritance Challenges

Navigating cryptocurrency estate planning means contending with hurdles unique to digital assets. Unlike physical property or traditional bank accounts, cryptocurrencies exist within decentralized networks detached from the conventional legal and financial infrastructures. This distinction brings several critical challenges to light.

Stay Sharp. Stay Ahead.

Join our Telegram Group for exclusive content, real insights,

engage with us and other members and get access to

insider updates, early news and top insights.

Join the Group

Join the Group

The Private Key Predicament

The greatest obstacle in crypto inheritance revolves around private keys: the cryptographic strings that confer exclusive control over blockchain assets. Unlike traditional bank accounts, there are no institutional recovery mechanisms for misplaced keys.

- No central authority. There’s no customer service to call or reset function for private keys.

- Irreversible transactions. Crypto assets sent to inaccessible wallets are gone permanently, with no recourse or recovery.

- No automatic inheritance. Unlike retirement accounts or insurance policies, crypto assets do not transfer automatically at death. There are no default beneficiaries embedded within blockchain protocols.

This forms the “private key paradox.” Maximize security and you risk inaccessibility for heirs. Prioritize ease of access, and you raise vulnerability to theft or loss. Striking an appropriate balance is crucial and must be tailored to each individual’s situation.

Legal and Technical Knowledge Gaps

Inheriting crypto assets presents most families with two significant knowledge barriers:

- Technical understanding. Even with clear written instructions, many heirs lack the experience to manage and transfer crypto safely. Missteps can result in irreversible loss.

- Legal ambiguity. Laws governing digital assets are still evolving. Many jurisdictions lack clear protocols for managing or distributing crypto upon death, leading to confusion and potential disputes.

A Cambridge University study on alternative finance revealed that more than 60% of crypto holders have never openly discussed inheritance plans with prospective beneficiaries. This lack of communication intensifies technical and legal risks. Heirs may not even know which assets exist or how to find them, let alone how to transfer ownership securely.

Security Versus Accessibility Tradeoffs

Every effective crypto estate plan must strike a carefully calibrated balance.

- High-security strategies (like cold storage, multi-signature wallets, or key sharding) keep assets safe during your lifetime but often create headaches or dead ends for heirs without technical experience.

- High-accessibility approaches simplify inheritance but can make assets more vulnerable to theft or mismanagement.

- Timing is critical, as cryptocurrency markets are volatile. Delays in transferring access can have a significant impact on asset value.

The best approach weighs the value of your holdings, your heirs’ technical comfort, and your personal dispositions. These tradeoffs make clear documentation and comprehensive inventorying the logical next step for any robust crypto estate strategy.

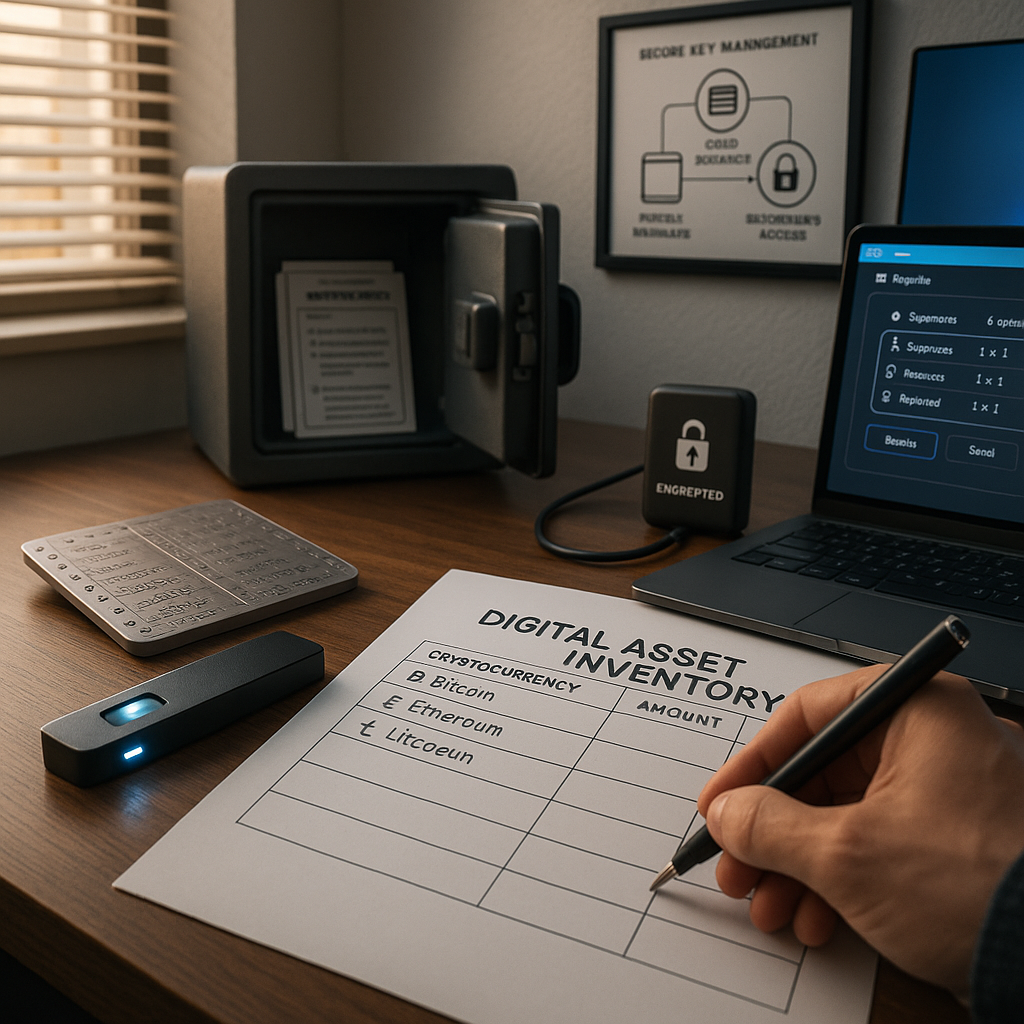

Creating a Digital Asset Inventory

A comprehensive digital asset inventory is the linchpin of effective crypto succession planning. Without clear records, even the savviest heirs could miss or permanently lose valuable assets. Your inventory acts as a detailed roadmap, giving beneficiaries every chance to locate and recover your digital estate.

Documenting Cryptocurrency Holdings

Start by building a structured inventory of all your cryptocurrencies. Include:

- Asset types and quantities: List each cryptocurrency (e.g., Bitcoin, Ethereum) and the approximate amount held.

- Acquisition details: Note purchase dates, purchase prices, and any details relevant for tax purposes.

- Storage locations: For each asset, indicate whether it’s located on an exchange, in a hardware wallet, or within software/app wallets.

- Purpose or category: Indicate if assets are set aside for specific goals (e.g., long-term holding, active trading, staking).

Organize this information in a clear, table-based format. Update your inventory after significant transactions and at least once each quarter. Remember, clarity is key. Aim to make it understandable for someone with little or no crypto experience.

Mapping Exchange Accounts and Wallets

Create a clear record for each wallet or exchange where assets are held.

For exchange accounts:

- Exchange name and official website

- Username (but never the password in the same place)

- Email address used for registration

- Type of two-factor authentication in use

- Support contact for the exchange

For hardware wallets:

- Manufacturer and model

- Where the device is physically stored

- PIN reminder (do not include the full PIN)

- Where the recovery seed or backup phrase is stored

For software wallets:

- Wallet name and version

- Host device (laptop, smartphone, etc.)

- Locations of any backup files

Providing this mapping creates “breadcrumbs” that guide heirs to the right accounts and devices, without exposing sensitive data during your lifetime.

Recording NFTs and Web3 Memberships

As the scope of digital assets broadens, it’s vital to include NFTs (non-fungible tokens) and Web3 memberships in your estate plan.

- List all NFT collections and unique digital art pieces, specifying wallet addresses and relevant marketplace accounts.

- Include any DAO tokens, community passes, and social platform profiles with relevant blockchain value.

- Identify any ongoing responsibilities or opportunities (staking rewards, governance participation, etc.).

NFTs and Web3 assets can carry both financial worth and emotional significance. Galaxy Digital’s 2022 survey found that over 30% of crypto holders own NFTs, but these assets are still frequently neglected in estate documentation. Including them ensures that every aspect of your digital legacy is addressed and preserved.

Stay Sharp. Stay Ahead.

Join our Telegram Group for exclusive content, real insights,

engage with us and other members and get access to

insider updates, early news and top insights.

Join the Group

Join the Group

Secure Storage Solutions for Recovery Information

An effective crypto estate plan depends on a system that keeps recovery information secure during your life, but straightforward to access once it’s needed by your heirs. Strategic storage methods are essential to achieving this balance.

Seed Phrase Protection Strategies

Seed phrases and private keys must be safeguarded rigorously. Their compromise means total loss of control, while their misplacement could bar all access for future heirs.

-

Physical storage approaches:

-

Laser-engraved metal plates (fireproof, waterproof, durable over decades)

-

Paper storage placed in secure, tamper-evident bags or fireproof safes

-

Bank or institution-managed safety deposit boxes

-

Security best practices:

-

Never store the entire seed phrase in a single location susceptible to natural disasters or theft

-

Use the 3-2-1 backup rule: keep three copies, use two types of media (metal, paper, etc.), and store one version off-site

-

Periodically check backups to ensure legibility and integrity

Remember, seed phrases are typically 12 or 24 words, crucial in the correct order. They cannot be reset if lost, so security and recoverability must be treated as top priorities.

Digital and Physical Storage Combinations

Using a hybrid strategy often delivers the best blend of safety and accessibility.

-

Digital security:

-

Place seed phrases or access credentials in encrypted drives with instructions for decryption

-

Use password managers with emergency access or digital legacy features

-

Leverage encrypted cloud storage protected by multifactor authentication

-

Physical documentation:

-

Supply plain-language, step-by-step guides for accessing stored information

-

Provide contacts for technical support

-

Make recovery instructions understandable for those unfamiliar with crypto concepts

Research by the Cremation Institute suggests nearly 90% of crypto holders fear asset loss after death, but fewer than a quarter have a documented plan for succession. Combining digital redundancy with physical documentation greatly increases the likelihood that assets are transferable without sacrificing security.

Advanced Protection Methods

For those with significant assets or heightened security needs, sophisticated solutions provide additional layers of protection.

- Key sharding (Shamir’s Secret Sharing): Divide your seed phrase so multiple parties must collaborate to reconstruct the full key.

- Dead man’s switch: Automated services or smart contracts that release access information after a set period of inactivity.

- Multi-signature wallets: Require more than one participant’s approval for any transactions, allowing for safer, supervised inheritance.

- Time-locked smart contracts: Enable transfers to execute automatically if certain conditions are met (for example, after a specified time period following account inactivity).

While highly secure, these methods can be complex. Thoroughly test recovery processes with trusted advisors or family members, ensuring instructions are foolproof for future beneficiaries, especially those without technical backgrounds.

Legal Frameworks for Crypto Inheritance

Legal integration is essential to ensure that your crypto holdings are distributed according to your wishes and that your heirs can act with authority and clarity. Traditional legal documents don’t naturally account for digital assets, but careful planning can bridge this gap.

Will Integration Best Practices

Your standard will should reference your crypto assets while maintaining operational security.

- Include language acknowledging the presence of cryptocurrencies and digital assets without listing specific values or details that could compromise privacy.

- Direct your executor to your secure, separate digital asset inventory for detailed access instructions.

- Appoint a knowledgeable digital executor (someone with the capability to manage digital assets and engage professional help as needed).

- Authorize your executor to work with technical consultants when required.

Sensitive details such as private keys, passwords, and complete wallet addresses should never appear in your will, as probate records may become public. Instead, your will should refer executors to separate, securely stored inventories and guides.

Trusts and Specialized Legal Structures

For large portfolios, trusts and specialized vehicles offer powerful control, privacy, and flexibility.

- Revocable living trusts: Allow for management of assets should you become incapacitated and can shield details from public probate processes.

- Directed trusts: Assign digital asset management to a technically qualified trustee, separating administration from beneficiary distributions.

Consult with estate attorneys experienced in digital asset law, as evolving regulations and new technologies demand up-to-date drafting. Collaboration with crypto specialists can optimize the intersection between technical access and legal execution, ensuring your plans remain both effective and compliant.

Expanding Beyond Crypto: Diverse Real-World Applications

While these estate planning fundamentals are vital for cryptocurrency, similar principles are relevant across multiple industries managing digital or complex assets. In healthcare, securing access to patient portals or confidential research data empowers family members and medical professionals during emergencies. In finance, digital documentation of portfolio details, trading platforms, and permissions enables smooth asset transfer after death or incapacitation. In education, online course assets, personal learning records, and cloud credentials can be documented for future use or transfer. In the legal sector, clear records of intellectual property rights, digital contracts, and client files preserve value and ensure compliance. These examples highlight the increasing importance of digital asset inventory and accessibility across modern life, not just within crypto.

Conclusion

Passing on cryptocurrency and other digital assets successfully requires a thoughtful blend of technical precision and legal rigor. This process is fundamentally different from traditional estate planning. The unique challenges of private key security, technical skill gaps among beneficiaries, and ever-evolving legal frameworks underscore the necessity for early, forward-looking planning.

Building a comprehensive and regularly updated digital asset inventory, combined with secure yet accessible storage solutions, provides enduring peace of mind for both you and your heirs. Integrating these strategies into legally recognized documents ensures that your digital wealth is not only preserved but also accessible to those you care about.

Looking forward, the capacity to design flexible, up-to-date estate plans is rapidly becoming a hallmark of smart financial stewardship in the decentralized economy. Whether you’re safeguarding crypto, managing cloud-based business tools, or overseeing digital intellectual property, the ability to anticipate change and educate your loved ones is your greatest advantage. It is not simply a matter of inheritance. It’s about empowering the next generation with knowledge, access, and the confidence to build upon your legacy in a digital-first world.

Leave a Reply