Key Takeaways

Understanding the differences between hard forks and soft forks is crucial for navigating blockchain upgrades and the evolving world of cryptocurrencies. This guide unpacks essential concepts and highlights how different types of forks impact the ecosystem, empowering beginners to tackle blockchain forks with clarity and confidence.

- Hard forks redefine blockchain rules and create new directions. A hard fork is a significant update that changes a blockchain’s core rules, making the new version incompatible with the old chain. This often results in a split, creating separate cryptocurrencies and histories (for example, Bitcoin Cash and Ethereum Classic).

- Soft forks upgrade with backward compatibility. Soft forks introduce new consensus rules while allowing older nodes to recognize newer blocks. This way, the blockchain can evolve as a single network, evident in upgrades like Bitcoin’s SegWit.

- Protocol forks shape governance and community decision-making. Every fork signals moments of choice for project communities, highlighting how decentralized governance operates and how consensus is achieved in open networks.

- Forks drive both innovation and risk. The process of forking allows developers to add features, enhance security, or align with new visions, but can also trigger confusion, duplicated assets, or increased vulnerability unless changes are managed transparently.

- Iconic hard forks reflect deep disagreements. Events like the Bitcoin Cash fork (focused on transaction speed) and the Ethereum Classic fork (a response to the DAO hack) arose from pivotal disputes about values, use cases, and the role of immutability in blockchain records.

- Knowledge of forks leads to safer crypto participation. By understanding fork types, you become better equipped to spot contentious upgrades, guard against scams, and make informed decisions about managing assets across potential splits.

Mastering these core ideas will guide you through major blockchain upgrades and help you avoid common pitfalls. Now, let’s uncover what forks mean for your crypto journey.

Introduction

Blockchain technology isn’t static. Occasionally, entire networks split, leading to the birth of new pathways, communities, and even currencies. The distinction between a hard fork and a soft fork goes far beyond technical terms. It influences the future direction of cryptocurrencies, affects who governs the network, and can have a direct impact on the safety of your crypto holdings.

Major events like the Bitcoin Cash and Ethereum Classic forks fundamentally changed the cryptocurrency landscape, often leaving newcomers puzzled about what had happened and why. If you are starting your journey in crypto or Web3, understanding the differences between types of protocol forks is essential for navigating upgrades, protecting your assets, and avoiding confusion. In the sections ahead, you’ll discover what sets hard forks apart from soft forks and why this knowledge is a foundational skill for safer and more empowered participation in the decentralized economy.

Stay Sharp. Stay Ahead.

Join our Telegram Group for exclusive content, real insights,

engage with us and other members and get access to

insider updates, early news and top insights.

Join the Group

Join the Group

Understanding Blockchain Forks: The Basics

To appreciate the role of forks, it’s vital to grasp how blockchain networks function. A blockchain is a distributed ledger where all participants maintain identical copies of the transaction record. As these networks develop, updates are occasionally necessary, demanding changes to the underlying protocol. These changes are what the crypto world calls “forks.”

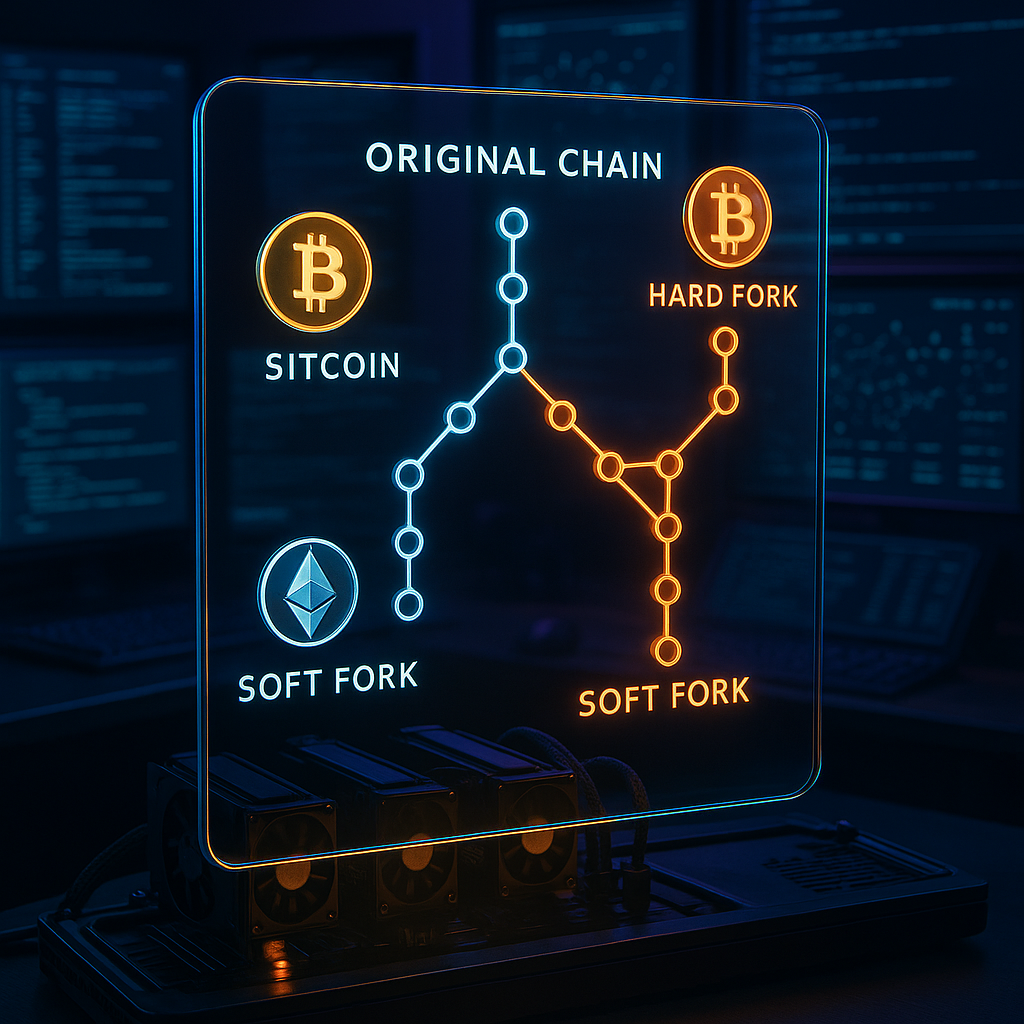

At their core, blockchain forks are protocol updates that cause either a temporary or permanent divergence in the network. Imagine a road suddenly splitting: the original path continues, but a new branch emerges, following different rules. Forks arise for several primary reasons:

- Protocol improvements: Improving security, efficiency, or performance

- Bug fixes: Addressing vulnerabilities or correcting software errors

- Community disagreements: Settling philosophical or governance disputes

- Adding features: Introducing new functions like smart contracts or privacy enhancements

Forks carry implications that go beyond technical theory. If you hold cryptocurrencies during a fork, you might end up with duplicate assets, need to take steps to protect your balance, or face new security challenges. Fork events also reflect the broader direction and internal health of a blockchain project, providing insights into how communities manage disagreement and adapt to change.

Each fork event sheds light on a project’s governance style. For instance, Bitcoin’s numerous forks highlight its community-driven and consensus-based approach, while other projects exhibit more centralized upgrade paths. The nature of decision-making during contentious forks reveals much about long-term sustainability and the adaptability of blockchain ecosystems.

Understanding forks isn’t only about technology. It’s about grasping community dynamics, risk, and the culture of crypto itself.

Hard Fork vs Soft Fork: Key Differences Explained

Definition and Technical Distinctions

A hard fork introduces protocol changes that are not backward compatible. After a hard fork, the updated software enforces new rules that conflict with those of the original network. If not everyone adopts the new version, the chain splits, creating two incompatible blockchains that develop independently. Users and miners must upgrade to interact with the new network; those who do not will continue to maintain the old blockchain.

A soft fork, on the other hand, is a backward-compatible update. It adds new rules or tightens existing ones so that older nodes, even if not updated, can still recognize and interact with new blocks, albeit without enforcing all the new constraints. The result is a unified network that continues to operate as one chain.

Picture a board game. A hard fork would mean introducing new rules that radically alter gameplay, leaving those who don’t adopt unable to play with the group. A soft fork is like adding an optional rule: players following the old setup can still play, but those using the new rules have a refined experience.

Compatibility and Node Requirements

Hard forks have clear technical requirements:

- Every node must upgrade to stay synchronized with the main network

- Nodes that do not upgrade become isolated, inevitably creating a separate chain

- Forked chains each have their own trajectory, user base, and ecosystem

- Commonly, a new cryptocurrency is issued to holders on the original network at the time of the split

Soft forks differ in their approach:

- Non-upgraded nodes continue to participate but may not enforce the new restrictions

- Generally, only miners and validators need to update software to enforce new protocols

- The blockchain remains singular and unified with no duplicated assets or histories

The disruptive nature of hard forks prompts wide-scale coordination and consensus. Soft forks encourage gradual adoption, maintaining harmony across the ecosystem.

Consensus Mechanisms in Different Fork Types

Hard forks typically require pre-fork consensus but, once initiated, often result in two factions with completely separate consensus systems. For proof-of-work blockchains like Bitcoin, miners choose which chain to support, splitting mining power and shaping the new network’s security and viability. This competitive dynamic can influence the long-term health and adoption of each split chain.

Soft forks rely chiefly on miner and validator majority to enforce new rules. If a majority of mining power supports the new standards, network cohesion is maintained. However, if consensus is weak, even a soft fork can lead to temporary disruptions or, in rare cases, an unintended chain split.

The mechanisms by which forks are agreed upon and implemented provide insight into a blockchain’s governance and the resilience of its decision-making processes. Hard forks embody disruptive, sometimes revolutionary change. Soft forks exemplify adaptive, incremental upgrades, each with distinct community implications.

The Impact of Hard Forks on Cryptocurrency Networks

Creation of New Cryptocurrencies

Hard forks are often most famous for giving rise to entirely new digital currencies, each with its own blockchain, community, and set of values. When a hard fork occurs, users holding the original cryptocurrency typically receive an equal amount of the new asset, similar to receiving a dividend.

Some major hard fork examples include:

Stay Sharp. Stay Ahead.

Join our Telegram Group for exclusive content, real insights,

engage with us and other members and get access to

insider updates, early news and top insights.

Join the Group

Join the Group

- Bitcoin Cash (BCH): Forked from Bitcoin in 2017 to increase block sizes and champion everyday payments

- Bitcoin Gold (BTG): Designed to decentralize mining by changing the mining algorithm, making it less dependent on specialized hardware

- Ethereum Classic (ETC): Formed after Ethereum’s response to the DAO hack, representing the “code is law” philosophy

These new projects create distinct communities and purposes. For instance, Bitcoin Cash brands itself as the true “peer-to-peer electronic cash,” while Bitcoin emphasizes robust security and scarcity.

Outside of cryptocurrency, hard forks also influence other decentralized domains. In the finance sector, a public blockchain fork can trigger rapid adjustments in DeFi protocols, airdrop new assets to users, and prompt institutions to review custody solutions for the forked coins. Similarly, in digital identity and supply chain management, a hard fork can reshape data provenance and access rights across participants.

Community and Ecosystem Division

A hard fork often emerges from entrenched disagreement over a blockchain’s future, resulting in contentious splits that fracture communities. The Bitcoin Cash split, for example, pitted those prioritizing scalability against those focused on preserving decentralization and robust security measures.

Such forks don’t just alter code; they split resources, divide attention, and create persistent competition in these areas:

- Core developer resources and talent

- Brand storytelling and global recognition

- Exchange and wallet infrastructure support

- Miner hash power and resulting network security

High-profile hard forks have led to lasting debates, market rivalry, and, in some cases, confusion among users unsure which version represents the “true” cryptocurrency.

This phenomenon isn’t limited to public blockchains. In legal environments, a hard fork could alter how digital evidence or contractual agreements are interpreted, prompting courts or regulators to recognize both chains separately, adding complexity and potential disputes.

Market Value Redistribution After Major Hard Forks

The runup to and aftermath of a hard fork are often accompanied by heightened market volatility. During a contentious hard fork, uncertainty can cause price swings in both the original and prospective new asset. Once the fork is completed, market participants quickly revalue each chain based on factors like developer support, exchange listing, real-world adoption, and perceived future potential.

Historical examples show considerable divergence after major forks:

- The value ratio of Bitcoin to Bitcoin Cash rapidly shifted as market confidence consolidated around one main chain

- Ethereum’s split into Ethereum and Ethereum Classic resulted in the former maintaining a dominant position, while ETC continued with minimal yet committed backing

- Both Bitcoin SV and its predecessor, Bitcoin Cash, lost ground to Bitcoin after their respective network splits

Hard fork value redistribution also influences businesses and users far beyond trading. In decentralized finance, asset duplication might impact synthetic contracts, on-chain insurance, or lending products. For NFT and digital asset holders, fork events can force important choices about provenance and attribution.

In every case, forks act as stress tests for network consensus, resilience, and the adaptability of surrounding ecosystem participants.

Navigating Soft Forks: Evolution Without Division

How Soft Forks Maintain Network Unity

Soft forks offer a cooperative route to network improvement, permitting new rules while preserving backward compatibility. Their primary strengths are:

- Unified community experience: No competing networks or fractured asset bases

- Reduced complexity for users and developers: One chain means simpler infrastructure and customer support

- Aligned incentives: All economic actors continue benefiting from the shared network, maximizing security and network effects

- Easier adoption: Exchanges, wallets, and nodes can upgrade at their own pace without threatening network stability

Soft forks are often orchestrated through extensive pre-implementation discussion, off-chain signaling, or miner voting mechanisms. Their incremental nature supports smoother rollouts and lets networks adapt to security or market shocks more gracefully.

The ability of soft forks to enable change without creating parallel currencies has proven valuable not only in cryptocurrency but also in sectors like supply chain tracking and digital healthcare record-keeping, where system integrity and compatibility matter most.

Notable Soft Fork Examples and Their Benefits

Several landmark soft forks demonstrate how networks have delivered real innovation with minimal disruption.

Bitcoin’s SegWit (Segregated Witness) Upgrade

Implemented in 2017, SegWit restructured the way data is stored in blocks, providing:

- Greater transaction throughput without directly increasing block size

- Solutions to malleability issues, fostering Layer 2 scalability (Lightning Network)

- Enhanced transaction capacity by 60-70% for the same base block size

Technical Analysis upgrades like SegWit not only improved technical performance, but also paved the way for advanced scaling solutions and broader adoption among developers building the next wave of financial infrastructure.

Pay to Script Hash (P2SH)

Introduced in Bitcoin in 2012, P2SH allowed for more versatile transaction types, like multisignature wallets and complex smart contracts, all while letting users send to a simple address format. This represented a leap in both usability and network flexibility without dividing the community.

Booming industries outside traditional cryptocurrency have benefited from soft forks as well. In the finance industry, soft forks allow blockchains supporting asset tokenization or digital identity to evolve regulatory compliance mechanisms smoothly. In healthcare, soft-fork-like upgrades support interoperability improvements in patient data management systems, avoiding costly or risky migration events.

These examples illustrate that, with careful upgrade paths and clear communication, blockchain networks can address emerging challenges without losing their unified, decentralized strengths.

Conclusion

A deep understanding of blockchain forks is more than a technical skill. It’s a lens through which we can observe how digital communities innovate, govern themselves, and navigate disagreement. Hard forks enable dramatic innovations and unlock new opportunities but can introduce division, risk, and lasting volatility. Soft forks, by contrast, show that powerful technological evolution is possible without fragmenting the very networks that underpin digital value.

For those new to crypto or expanding their blockchain expertise, recognizing the implications of each fork type allows you to navigate protocol changes with greater confidence. You will be better prepared to safeguard your assets, avoid common pitfalls, and understand the true governance mechanics that drive adaptation in decentralized systems.

Looking forward, the next wave of blockchain and Web3 evolution will demand even greater adaptability, transparency, and community wisdom. The networks that flourish will be those that manage change thoughtfully, whether through consensus-driven soft forks or well-communicated hard forks that reflect clear visions for the future. The real challenge is not just reacting to forks, but learning to anticipate them and leveraging each upgrade as an opportunity for smarter, more empowered participation in the decentralized world. Now more than ever, your understanding of forks will be a strategic advantage on your journey through crypto. Learn. Earn. Repeat.

Leave a Reply