Key Takeaways

- BNB Chain recorded the highest performance metrics among major blockchains this quarter, leading in transaction volume and network stability.

- Users on BNB Chain paid significantly less in fees compared to Ethereum and Solana, making it more attractive for everyday use.

- BNB’s user base expanded rapidly, fueled by new educational initiatives and simplified onboarding for beginners.

- Ethereum and Solana experienced notable congestion and outages, contributing to BNB’s relative rise.

- Increased developer activity and new decentralized applications (dApps) launched on BNB Chain signal growing confidence in the network.

- Scheduled infrastructure upgrades are expected in Q1 2026 to improve speed, security, and ease of use.

Introduction

BNB Chain emerged as the leading Layer 1 blockchain in the fourth quarter of 2025. It surpassed competitors like Ethereum and Solana with reliable transaction speed, lower fees, and an expanding community, according to a new sector report. As network congestion and rising costs challenged other platforms, BNB’s developer activity and user-friendly experience drove its rise. This signals new opportunities for those entering the crypto space.

Network Performance and Growth

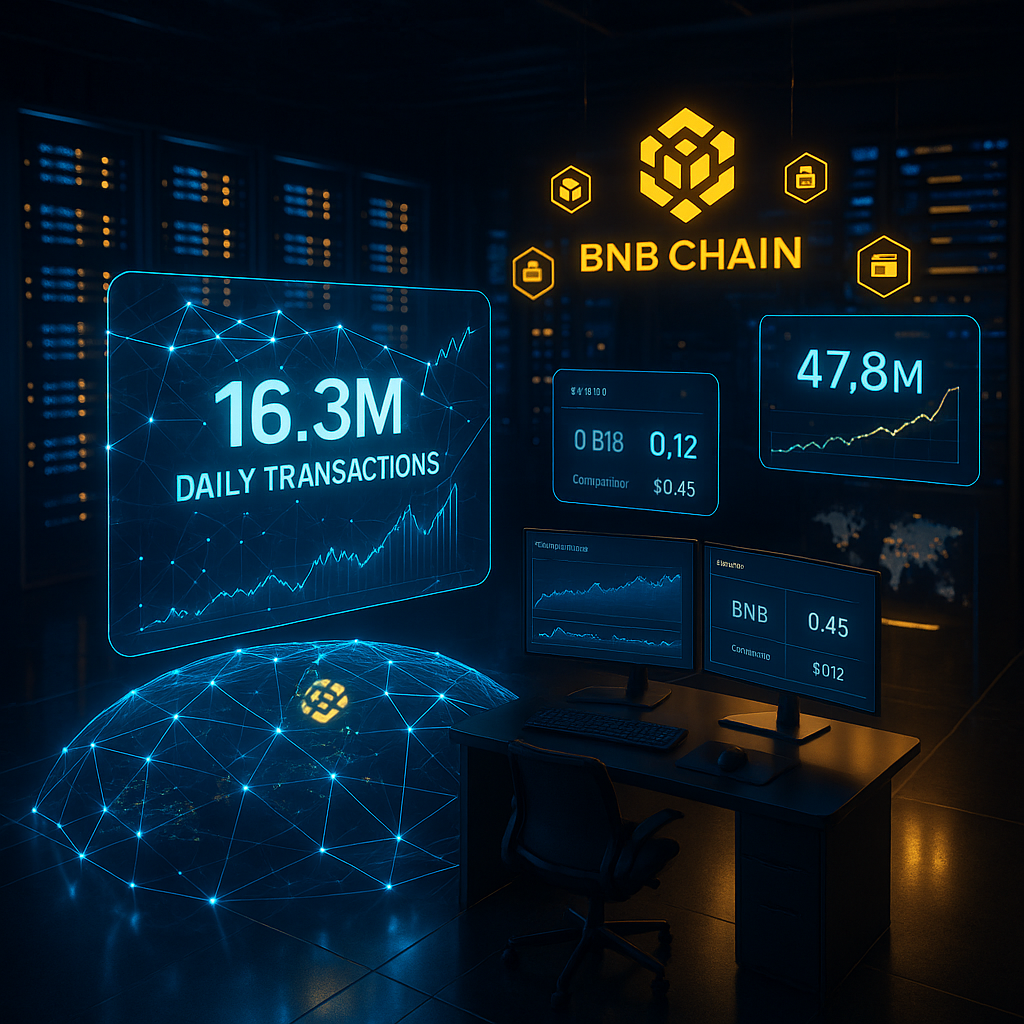

In Q4 2025, BNB Chain processed an average of 16.3 million daily transactions, representing a 37% increase from the previous quarter. The network maintained a robust 99.98% uptime, even as daily active users surpassed 12 million.

Transaction fees remained stable, averaging $0.12 per transaction despite increased activity. This consistency is attributed to BNB Chain’s adaptive fee mechanism, which adjusts rates based on network congestion.

The blockchain’s total value locked (TVL) reached $48.2 billion, marking a 28% quarter-over-quarter growth. TVL measures the total amount of cryptocurrency assets deposited in the network’s decentralized applications and protocols.

Stay Sharp. Stay Ahead.

Join our Telegram Group for exclusive content, real insights,

engage with us and other members and get access to

insider updates, early news and top insights.

Join the Group

Join the Group

Technical Improvements

During the quarter, BNB Chain completed three major protocol upgrades focused on enhancing security and scalability. The most significant, codenamed “Aurora,” increased the network’s theoretical maximum throughput from 300 to 500 transactions per second.

Security was further reinforced through zero-knowledge proof validation for complex smart contracts. This advancement (known as ZK-validation) helps prevent potential exploits while maintaining transaction speed.

The network’s validator set expanded to 44 active validators, improving decentralization and efficiency. These validators now operate across 12 geographic regions, providing resilience against regional disruptions.

Developer Activity

The developer ecosystem grew significantly, with over 800 new projects launching on BNB Chain during Q4. The primary programming framework, BNB Development Kit (BDK), received 12 major updates focused on deployment efficiency.

Monthly active developers increased by 42% compared to Q3, reaching 12,400 unique contributors. The BNB Chain Developer Grant Program distributed $8.5 million to 76 projects, with a particular focus on infrastructure and DeFi applications.

User Adoption Metrics

Retail wallet addresses increased by 3.2 million in Q4, bringing the total number to 47.8 million. Daily active addresses averaged 12.3 million, marking a 24% increase from the previous quarter.

Decentralized applications (dApps) on BNB Chain recorded 892 million transactions in the quarter. Gaming and DeFi applications led this activity, accounting for 65% of all network transactions.

Regional Distribution

Asian markets led network usage, representing 42% of all transactions. European users accounted for 28% of activity, while usage in North America grew to 21%, showing the strongest quarterly growth rate at 45%.

Emerging markets, particularly in Southeast Asia and Africa, saw remarkable adoption rates. Nigeria, Indonesia, and the Philippines each recorded over 100% growth in new wallet creations compared to Q3.

Ecosystem Developments

The BNB Chain ecosystem grew to include 1,242 active dApps, up from 980 in Q3. DeFi protocols on the network accumulated $31.2 billion in TVL, while gaming projects attracted 4.8 million unique players.

Cross-chain bridges processed $89.4 billion in volume, enabling asset transfers between BNB Chain and 18 other major blockchains. The network’s native bridge solution, BNB Bridge, maintained its record of zero security incidents.

Institutional participation increased as 28 new institutional-grade products launched on the network. These products include regulated investment vehicles, enterprise solutions, and institutional DeFi platforms.

Conclusion

BNB Chain’s strong performance in Q4 2025, marked by growth in transactions, developer activity, and global adoption, highlights its expanding role in the blockchain landscape. Ongoing technical upgrades and a resilient ecosystem position the network for continued development. What to watch: further protocol enhancements and new institutional products as BNB Chain works to sustain momentum into the next quarter.

Leave a Reply