Cryptocurrencies

-

Airdrop vs Staking: Which Crypto Passive Income Method Wins?

.

Key Takeaways Earn free crypto without risk through airdrops: Token airdrops reward you with free coins or tokens, often for simply holding a wallet, signing up, or meeting basic criteria. This helps you grow your portfolio without locking up funds…

-

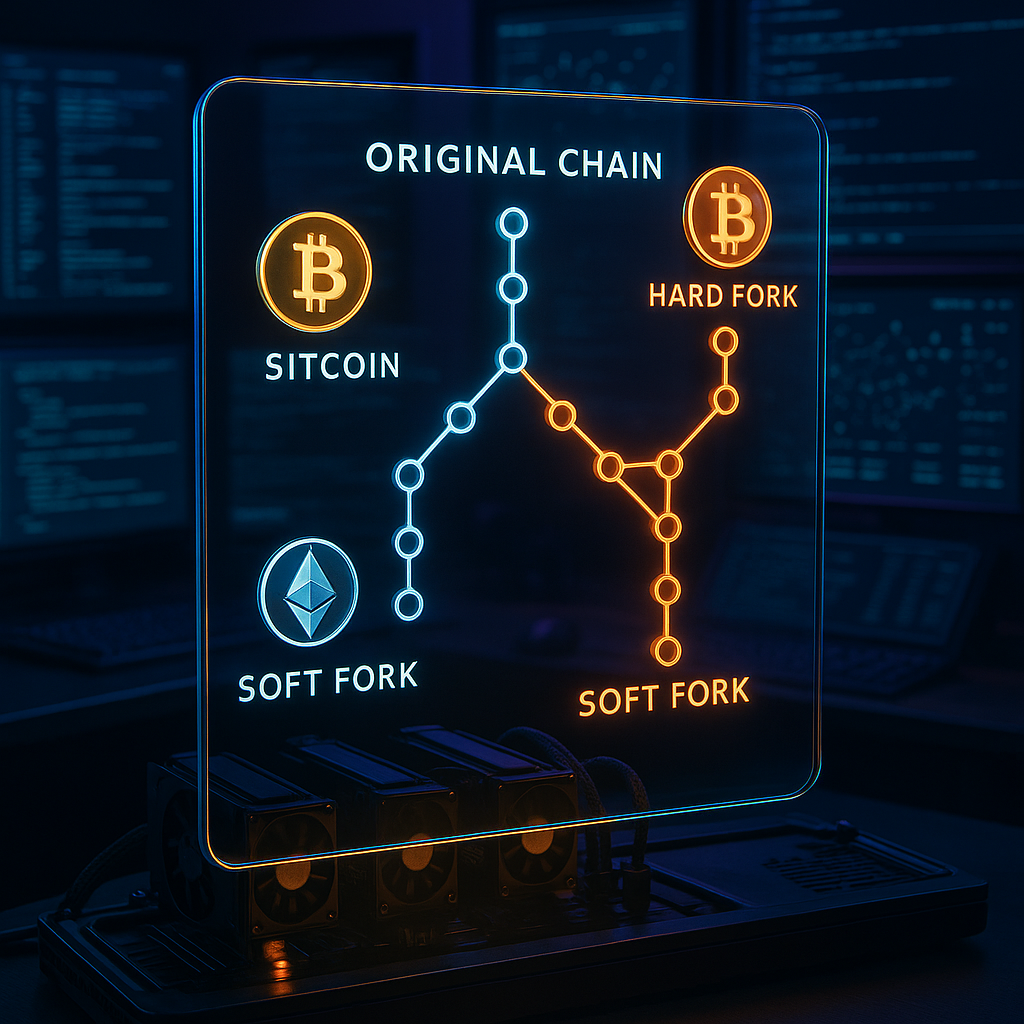

Hard Fork vs Soft Fork: The Complete Blockchain Upgrade Guide

.

Key Takeaways Understanding the differences between hard forks and soft forks is crucial for navigating blockchain upgrades and the evolving world of cryptocurrencies. This guide unpacks essential concepts and highlights how different types of forks impact the ecosystem, empowering beginners…

-

Meme Coins Analysis: Dogecoin & Shiba Inu Risks, Trends, and Volatility Explained

.

Key Takeaways Meme coins such as Dogecoin and Shiba Inu have transformed from internet jokes into influential digital assets within the broader cryptocurrency ecosystem. This analysis explores the unique blend of hype, volatility, community momentum, and emerging utility that characterizes…

-

Proof of Stake vs Proof of Work vs Proof of History: Blockchain Consensus Explained

.

Key Takeaways Proof of Work: Security through computational muscle. PoW relies on miners solving complex mathematical puzzles, securing blockchains like Bitcoin, but consuming significant energy and favoring participants with powerful hardware. Proof of Stake: Efficiency without heavy lifting. PoS secures…

-

Privacy Coins Comparison 2025: Monero vs Zcash vs Dash & Global Regulations

.

Key Takeaways As debates around cryptocurrency privacy intensify, 2025 introduces new complexity in understanding how leading privacy coins operate amid regulatory tightening and rapid technological innovation. This article provides a data-driven comparison of Monero, Zcash, and Dash while also exploring…

-

NFTfi Demystified: Lending, Renting & Fractionalization in DeFi

.

Key Takeaways NFT lending protocols are bridging illiquid assets with decentralized finance (DeFi). By allowing users to borrow against their NFTs, these protocols unlock liquidity that was previously inaccessible. They leverage smart contracts and collateralized loan structures adapted for the…

-

DePIN Tokens Explained: Investment Potential & Real-World Uses in 2025

.

Key Takeaways DePIN tokens are ushering in a new era of innovation by transforming the way we build, operate, and invest in decentralized physical infrastructure networks. As blockchain and the Internet of Things (IoT) converge, it is essential to understand…

-

Wrapped Tokens Explained: How Crypto Enables Faster, Cheaper Remittances

.

Key Takeaways Unlock borderless transfers with wrapped tokens: Wrapped tokens empower users to transfer assets such as Bitcoin or Ethereum across previously incompatible blockchains. This approach overcomes longstanding limitations, streamlining global value transfers and making them more accessible to people…

-

DePIN Tokens Explained: How Decentralized Physical Infrastructure Networks Work & Where to Invest

.

Key Takeaways Democratizing access to physical infrastructure: DePIN networks are lowering traditional barriers, allowing individuals to own, operate, and benefit from critical resources such as wireless networks, energy grids, and data storage systems. This challenges longstanding dominance by corporate giants…

-

Bitcoin Halving History: Price, Mining & What to Expect in 2025

.

Key Takeaways Halvings enforce digital scarcity, fueling Bitcoin’s value proposition. Every four years (approximately 210,000 blocks), the Bitcoin block reward is cut in half, reducing the new BTC entering circulation. This protocol-driven supply reduction mimics the scarcity of precious resources…