Key Takeaways

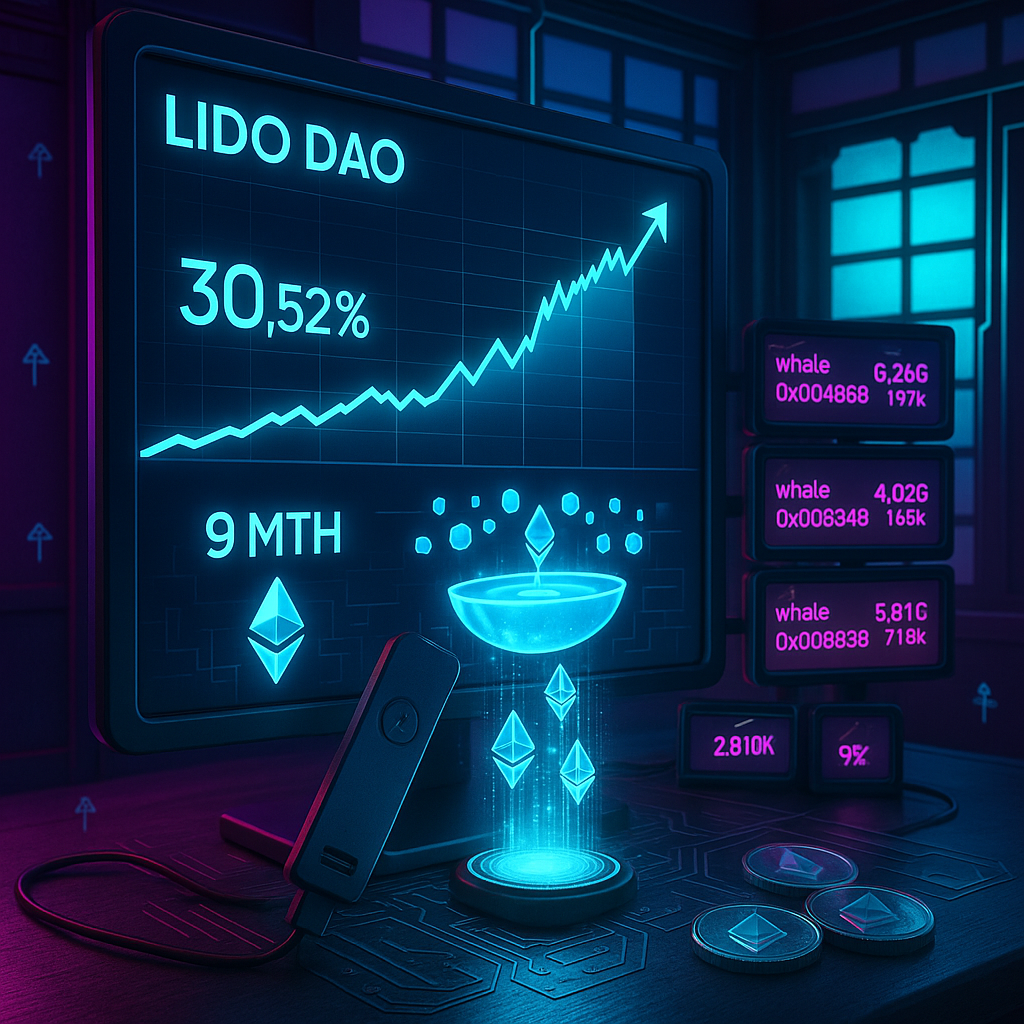

- Lido DAO Token rises 30%: The token experienced a notable increase as investors boosted their stakes, driving demand and higher prices.

- Major investors drive momentum: Large-scale holders, also known as “whales,” contributed significantly to the surge.

- Market uncertainty persists: This growth occurred while traditional assets and many other cryptocurrencies remained volatile or stable.

- Potential as a portfolio hedge: Lido DAO’s performance during market turbulence suggests it could help buffer against broader market swings.

- Increased interest in liquid staking: As Lido specializes in Ethereum liquid staking, the spike reflects growing confidence in this segment.

- Next: Monitoring for sustained growth: Investors and analysts are watching to see if Lido DAO can maintain its gains or if profit-taking will slow momentum.

Introduction

Lido DAO Token surged 30% in the past 24 hours as major investors increased their holdings, distinguishing the token from an otherwise uncertain crypto market. This rise has drawn attention to Lido DAO’s potential as a stable option for newcomers and investors seeking resilience during periods of volatility, particularly as interest in Ethereum-linked liquid staking grows.

Key Drivers Behind the Lido DAO Token Surge

Lido DAO’s native token (LDO) saw a notable 30% price increase over the past 24 hours, reaching $2.45. Trading volumes climbed sharply, with daily transactions surpassing $150 million across major cryptocurrency exchanges.

Large investors have significantly expanded their LDO positions. On-chain data indicates that wallets holding over $1 million in LDO grew their balances by roughly 15% this week, highlighting robust institutional interest.

Analysts attribute much of this growth to Lido’s leading role in Ethereum staking services. The platform currently manages over 9 million staked ETH, representing nearly 32% of all staked Ethereum tokens.

Stay Sharp. Stay Ahead.

Join our Telegram Group for exclusive content, real insights,

engage with us and other members and get access to

insider updates, early news and top insights.

Join the Group

Join the Group

Understanding Lido’s Market Position

Lido DAO is a decentralized staking platform that enables users to earn rewards on their Ethereum without needing the 32 ETH typically required for independent staking. This accessible model has attracted both retail and institutional investors.

The platform’s steady growth has continued despite broader market uncertainty, showing unusual strength when many crypto projects report declining engagement. Lido’s total value locked (TVL) has maintained a consistent upward trend.

Recent protocol enhancements, including improved security and reduced staking fees, have further increased user trust. These technical upgrades align with the platform’s long-term focus on sustainable growth rather than just short-term spikes.

Market Impact and Industry Response

Recent trading data shows the LDO token surge has drawn new participants to the platform. There was a 25% increase in active wallets interacting with Lido’s smart contracts compared to the previous month.

Industry experts highlight Lido’s transparent governance model as a key differentiator. Sarah Chen, a digital assets analyst at BlockResearch, stated that consistent growth in staking deposits signals users’ appreciation for Lido’s clear operational approach.

The platform’s recent momentum has prompted other staking service providers to review their fee structures and user accessibility in light of Lido’s example.

Technical Developments and Future Outlook

Recent protocol upgrades have strengthened Lido’s infrastructure and improved operational efficiency. The team successfully implemented smart contract enhancements that lower gas fees for users and uphold stringent security standards.

Development activity remains high, with several technical proposals under review by the DAO community. These proposals aim to broaden staking options and refine yield optimization strategies.

In the governance forum, community members are actively discussing potential network expansions and new partnerships. Ongoing votes concern cross-chain functionality and added staking features.

Conclusion

Lido DAO’s token surge highlights rising confidence in its staking model and transparent governance, reinforcing its leadership in Ethereum staking despite market uncertainty. The platform’s ongoing technical improvements and increased institutional adoption demonstrate its resilience and appeal to both newcomers and experienced participants. What to watch: community decisions on cross-chain functionality and new staking features, which will shape the platform’s next phase of growth.

Leave a Reply